In this article, I will discuss the Head and Shoulder Patterns in Trading. Please read our previous article, in which we discussed multiple time frame analyses in detail. As part of this article, we are going to discuss the following pointers in detail, which are related to the Head and Shoulder patterns in Trading.

- What is the head and shoulder pattern

- Types of head and shoulder patterns

- Failed head and shoulder pattern

- How to enter a head and shoulder pattern

Head and Shoulder Patterns:

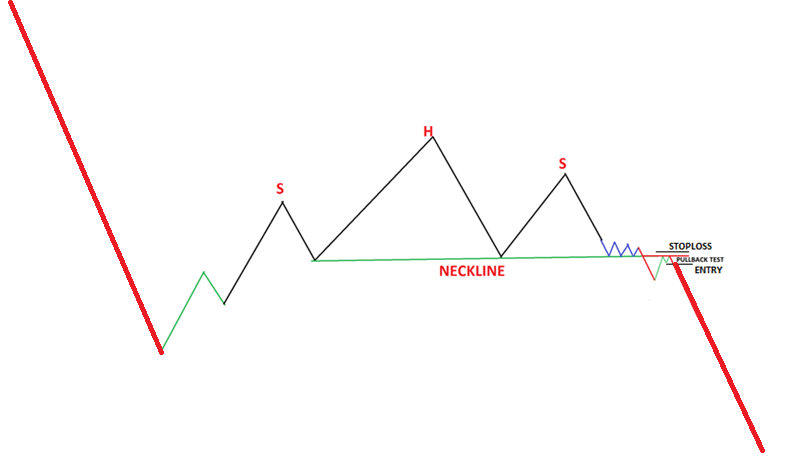

The Head and Shoulders pattern signals a possible trend reversal from a bullish to a bearish trend. The opposite of it is called the Inverse Head and Shoulders pattern, which signals a possible trend reversal from a bearish to a bullish trend. It consists of four parts:

- The left shoulder

- The head

- The right shoulder

- The neckline

Here’s what I mean:

Left Shoulder:

The market does pull back. At this point, there’s no way to tell if it will reverse because pullbacks occur regularly in a trending market. The left shoulder moves up on big volume and retraces on lower volume.

Head:

The market breaks and trades above the previous high. However, the sellers took control and drive the price lower towards the previous swing low (forming the Neckline). Higher high (head) on lower volume than left shoulder, then retrace that goes below the left shoulder.

Right Shoulder:

The buyers make a final attempt to push the price higher, but it failed to break above the previous high (the head). Then, the sellers take control and push the price towards the Neckline.

Then, it forms first lower high (right shoulder) on lower volume than the head. Sellers take control and drive the price down on more volume than the previous upswing volume not confirmed until it breaks the neckline.

Neckline:

This is the last line of defense for the buyers. If the price breaks below it with heavy volume, the market could head lower and begin the start of a downtrend.

Head and Shoulder Pattern Type

The Failed Head And Shoulders Pattern

Once prices have moved through the neckline and completed a head and shoulders pattern. Once the neckline has been broken on the downside, any close back above the neckline is a serious warning that the initial breakdown was probably a bad signal and creates what is often called, for obvious reasons, a failed head and shoulders and prices resume their original trend.

WHEN HEAD AND SHOULDER PATTERN FAILED

IF

- The pattern appeared in a strong trend

- The duration of the pattern is small

Let me explain to you

1. The pattern appeared in a strong trend

The preceding trend is before the head and shoulders pattern. If the market is in a strong uptrend, it’s unlikely that a simple chart pattern can reverse the entire move.

2. The duration of the pattern is small

If the pattern takes a short time, it is less likely to reverse a trend; it’s just a complex pullback. Here’s the thing: Head and Shoulders that take more time to form are more significant than those that take less time to form.

Why?

If the market breaks the more time pattern Neckline, more traders will get “trapped,” and their rush for exit will increase the selling pressure.

HOW TO ENTER A TRADE

For head and shoulder pattern entry condition

- The higher timeframe is in a downtrend

- The Head and Shoulders pattern formed at Resistance on the higher timeframe

- Volume confirmation

Entry method

- The tight range at the neckline breaks out

- The breakout test of the neckline

- The first pullback

- Professional entry

1. The tight range at the neckline breaks out

PRICE drives down to the neckline and forms a tight range. enter when the price breaks down from NECKLINE and place stop loss above the tight range.

2. The breakout test of the neckline

Often, the head and shoulder pattern may break down without forming a TIGHT RANGE. U MISSED THE OPPORTUNITY. If the market breaks down without forming a TIGHT RANGE, then wait for a pullback to occur. Price breakdown from the neckline and low volume test (PULLBACK) of the neckline is a high probability short opportunity

What you want to pay attention to is previous support (neckline) that could act as resistance. If the market comes into this area (neckline) and it gets rejected, this now is a favorable trade location to look for short trading setups. And your stops can go above the neckline. So, here’s an example:

3. The first pullback

- If the market breaks down without forming a TIGHT RANGE, then wait for a pullback to occur.

- If the market does a pullback(flag or tight range )with low volume and narrow range candle with upper wick, then go short on the break of the lows.

- Set your stop loss above the highs of the pullback

So, this is what I mean by the first pullback, and here’s an example:

4. PROFESSIONAL ENTRY

Here’s how…

- Wait for the market to form the Left Shoulder and Head

- After it’s formed, let the price rally higher back towards the Head with low volume and narrow candle

- Go short when you get a price rejection (like Shooting Star, Bearish Engulfing pattern, outside reversal bar)

Here’s an example: Ahead of the Crowd.