In this blog, I will discuss how to Day Trade with Trend in detail. Please read our previous article about How to Trade with the Supply and Demand Zone. As part of this blog, we are going to discuss the following pointers related to Day Trading with Trend.

- Why is trend analysis required for day trading?

- Structure of the market in detail

- How do you trade with uptrend, downtrend, and sideways markets?

- Characteristics of each trend

- How do we analyze each trend?

- When does the trend end?

I WOULD SUGGEST GO THROUGH THE Price Action Analysis article BEFORE GOING FORWARD.

Why Trend Analysis for Day Trading?

Trading against the trend, without a trend, or poor quality trends are among the most common reasons for trade failure. The quality or strong trends have more predictable success (edge).

The controlled arrangement of price bars and pullbacks provides greater certainty that reverses in supply and demand will happen. Poor or weak trends are less predictable. The uncontrolled arrangement of price bars and pullbacks in supply and demand lessens the chances of a reversal.

STRUCTURE OF MARKET OF MARKET

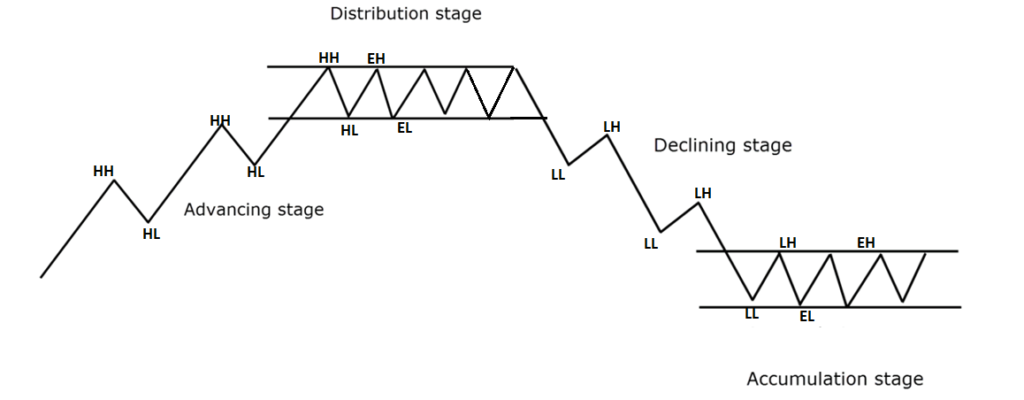

The price goes through 4 Phases

- ACCUMULATION (sideways market)

- UPTREND(trending up)

- DISTRIBUTION (sideways market)

- DOWNTREND (trending down)

ACCUMULATION (SIDEWAYS MARKET)

Smart money is removed from the floating supply of stock by buying, a process called accumulation. The accumulation phase looks like a range market after an extended downtrend.

A market is in a range when trading between Support and Resistance. Price Stuck between Resistance and Support. Not move in any direction. Generally, in the accumulation stage, we will see

- Normal or narrow-range candle

- Both mix the green and red candle

- Low volume

- Take more time

- Price in a tight range

As time goes by, stops will gradually build up beyond the range as traders long near the lows and short near the highs of the range.

No guarantee that the market will reverse from here. But it should alert you to the possibility that the bears are getting weak, and the bulls could take control and push the price higher above the highs of the range.

How to Enter the Accumulation

3 TYPES OF ENTRY FROM ACCUMULATION

- Spring entry

- Break out entry

- Break out pullback(flat or test ) entry

If the range’s lows coincide with Support on the higher timeframe, it greatly increases the odds of the market breaking out higher. Let me explain: the big picture is bullish, but the lower timeframe has a downtrend, and the lower timeframe trend stops at a higher timeframe resistance.

Advertisements

Advertisements

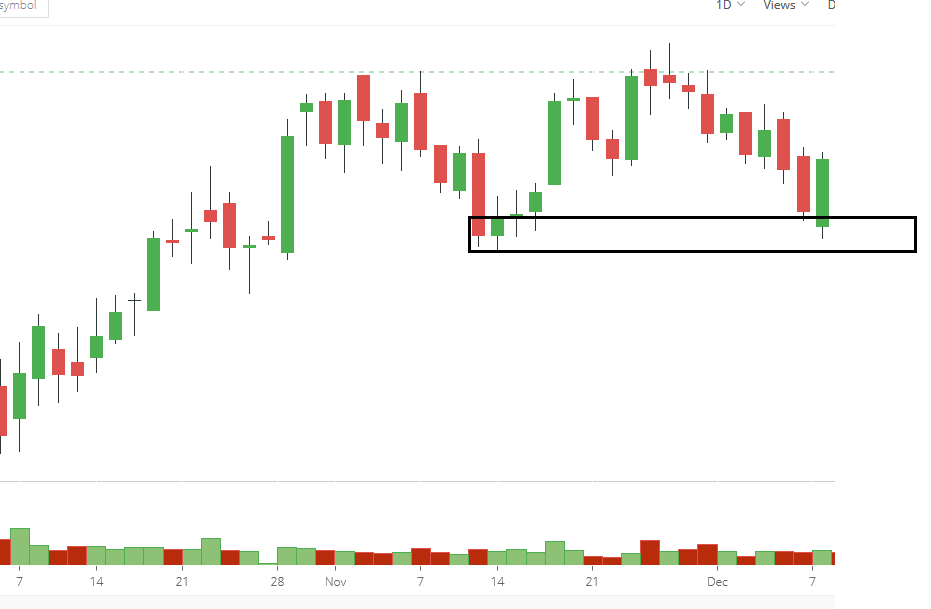

UPDATED DAILY CHART

This means you wait for the price to come to an area of Support daily and then look for the break of accumulation on your trading timeframe.

UPTREND

Smart money is aggressively moving prices up. The advancing phase is essentially an uptrend, with prices making higher highs and lows. Market moves in up and downswing

In a healthy bull trend, the upswing generally exceeds the downswing in length and makes a higher high and higher low, and the reverse is true for the bear market

Price Make Higher High (HH) and Higher Low (HL)

Generally in the advancing stage:

- There are more bullish than bearish candles

- The bullish candles are larger than the bearish candles

- Volume increases on the upswing and decreases on the downswing

Bullish bars close to opposite extremes or at near-high

Now… the advancing stage eventually will need to “take a break” because the early buyers will start taking profits, and sellers will look to short the markets as prices are at attractive levels.

Different types of trends.

They are:

- Strong trend

- Healthy trend

- Weak trend

Strong uptrend

- In a strong uptrend, the buyers are in control with little selling pressure.

- You can expect this trend to have shallow pullbacks (flat sideways)with low-volume

- Barely retracing beyond the 20 EMA.

- A bullish wide-range bar is more than bearish.

This makes it difficult to enter on a pullback because the market hardly retraces and continues trading higher. The best way to trade this trend is on a breakout

ANALYZE YOURSELF:

Advertisements

Advertisements

Healthy uptrend

In a healthy uptrend, the buyers are still in control with the presence of selling pressure (possibly due to traders taking profits or traders looking to take counter-trend setups).

You can expect this trend to have a decent retracement, usually towards the 20EMA, which provides an opportunity entry with the trend. Low volume pullback with narrow range or lower wick candle

Weak uptrend/choppy trend

- In a weak uptrend, buyers and sellers are almost equal control, with the buyers having a slight advantage.

- You can expect the market to have steep pullbacks and trades beyond the 20EMA.

- Generally choppy price action

- The market breaks out of the highs only to retrace back much lower (which makes it prone to false breakout). Pullbacks are often breakthrough areas of minor demand (uptrend) or minor supply (downtrend)

- The majority of open prices will be into 50% or more of the prior bar range.

- Close may not move in the direction of the previous bar

- New bar open and close not near extremes, meaning tails

- Display uncertainty

The best way to enter this trend is to support or Resist.

Analyze yourself

Tick by Tick: Secrets to Day Trading Success Class 2: Technical Analysis

DISTRIBUTION

SM will take advantage of the higher prices obtained in the rally to make profits by beginning to sell the stock back to the uninformed traders/investors.

ALL THE INFORMATION PROVIDED ABOVE IS REVERSE FOR THE DISTRIBUTION AND DECLINE PHASE

DOWNTREND

Price makes Lower High (LH) and Lower Low. (LL)

When does a trend end?

An uptrend is officially over when the stock has put in two lower highs and two lower lows in a particular time frame. A downtrend is officially over when the stock has put in two higher lows and two higher highs in a particular time frame.

Remember, day trading involves substantial risk and the possibility of rapid financial loss. It’s crucial to practice strategies in a simulated environment and to have a thorough understanding of the markets before committing to real capital. Always stay informed and continuously educate yourself to adapt to changing market conditions.