In this blog, I will discuss Multiple Time Frame Analysis in Trading. Please read our previous article discussing How to Day Trade with Trend in detail. If you identify level correctly and confluence across different time frames, you can actually increase your winning trade. So, as part of this article, we will discuss the following pointers, which are related to multiple time frame analysis.

- What is multiple timeframe analysis?

- Understanding the trend with multiple timeframe analysis.

- How do you use multiple time frames in trading?

- Advantages of multiple timeframe analysis.

- Entry principle for multiple time frames.

Trend Analysis

Once we identify the current trend, we need to anticipate what would occur to make the price fall into a sideways trend or reverse. Some common reversal patterns are

- 123 REVERSAL

- Double Top/bottom

- RANGE

- Up THRUST/SPRING

- Head and shoulder

WHAT IS FRACTAL?

Fractals are just smaller things that combine to create bigger things. Each of the smaller things is identical in shape to the larger thing.

How do Fractals apply to Financial Markets?

Markets behave like nature, creating “Patterns Within Patterns” from smaller timeframes to larger ones. Larger timeframe swings are comprised of several identical smaller-timeframe swings.

We use a “Factor of Five” to break up the different timeframes.

- A month is around 25 trading days, so 25/5 = 5 weeks

- Weak is 5 days trading day s 5/5=1 day

- The day is around 6:30 active hours, so 6:30/5=78 minutes

- Even lower time frame 78/5=15 minutes for day trading

What is Multiple Time Frame Analysis?

The multi-timeframe analysis is nothing but an analysis of multiple timeframe charts of a single instrument. Let’s understand in a chart

Let’s see an example with three timeframes

Understanding Trends with Multiple Time Frames

There are two major rules for multiple timeframe analysis:

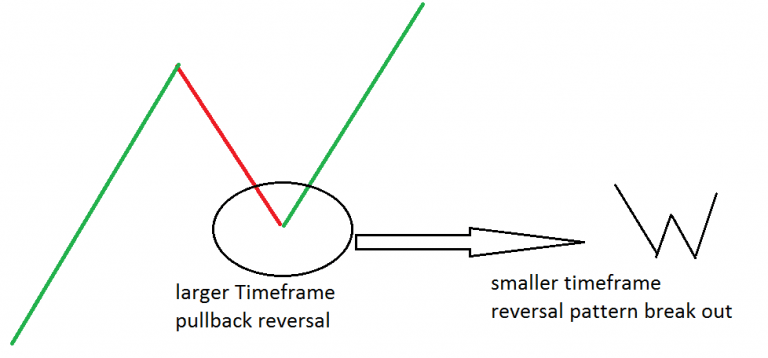

- Larger Timeframes establish and dominate the trend.

- Reversals start from the smaller timeframes first and propagate upwards.

Let’s go back to our two main price action rules.

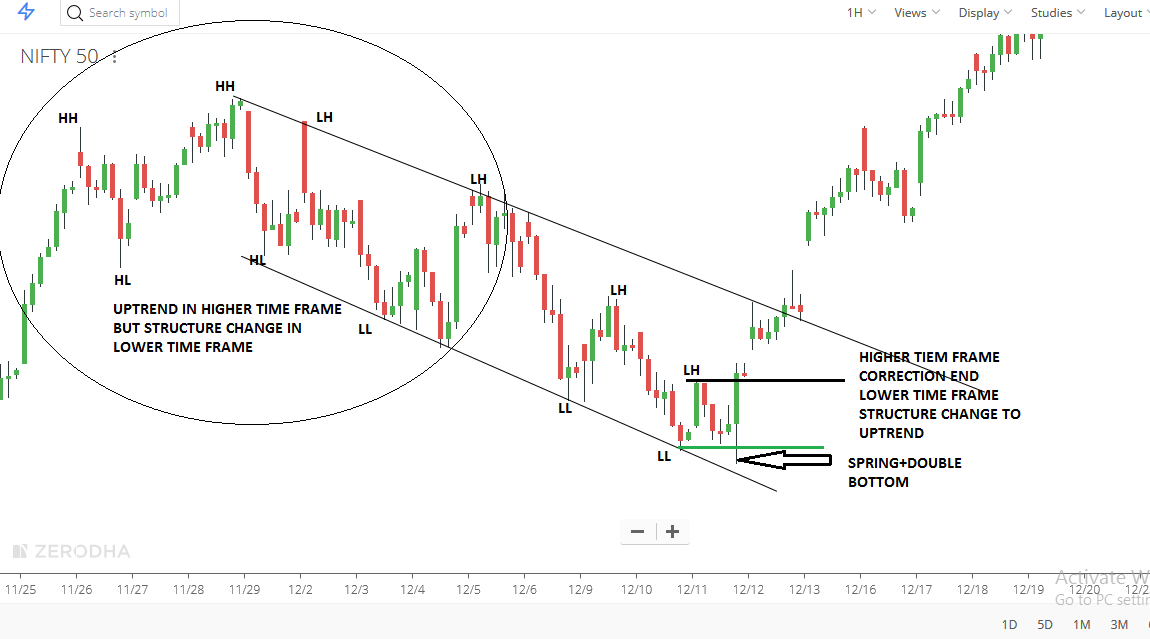

Larger Timeframes establish and dominate the trend.

This means when a larger timeframe trend is in play, you will see pullbacks on the smaller timeframes.

Reversals start from the smaller timeframes first and propagate upwards

This means that we’ll see this changing structure first on the shorter timeframe charts.

HOW TO USE MULTIPLE TIME FRAMES?

Use 1:

We can differentiate a “pullback” on the smaller time frame chart from the beginning of a correction in the larger time frame. Let me explain.

Use 2:

We can read the “smaller” timeframes to see when that pullback will reverse.

Use 3:

We will also be able to spot potential reversals before the structure change

Advantages of Using Multiple Time Frames:

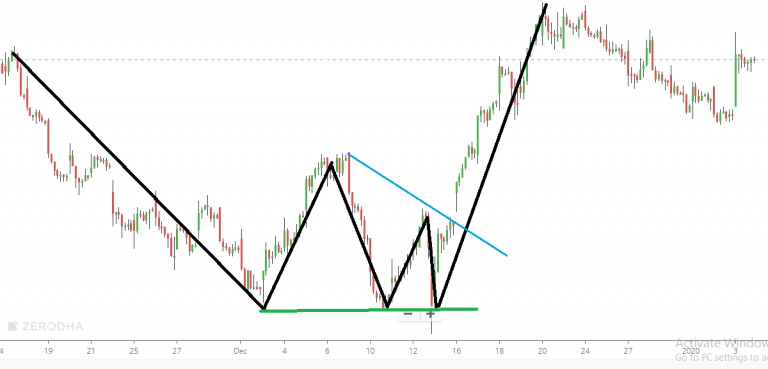

- Allowing the trader to get a micro view of larger time frames, which can, in turn, confirm the trader’s original analysis of trade. It is like using a backup pattern and fine-tuning an entry. An example would be having a pattern on a 60-minute chart and using a 5-minute chart to confirm the entry. (See Figures 8.12 through 8.14 as an example.)

- Risk can be managed more effectively by combining time frames. A trader can learn to move stops on smaller time frames for patterns that complete on larger time frames.

- Using multiple time frames, from larger to smaller, can help the trader be aware of contrary or opposing patterns that form on smaller time frames that are against the longer-term time frame.

MULTIPLE TIME FRAME ENTRY PRINCIPLE

- Define your “signal” chart. For swing traders, this will generally be a Daily chart. For Day traders, it will be a smaller timeframe like a 2/5/10/15-minute chart.

- Add a higher time frame chart that is either 5x or 25x larger than your signal chart.

- Trade your signal chart as before, but trade in the direction of the swings on that higher timeframe chart!

Let me explain to you.

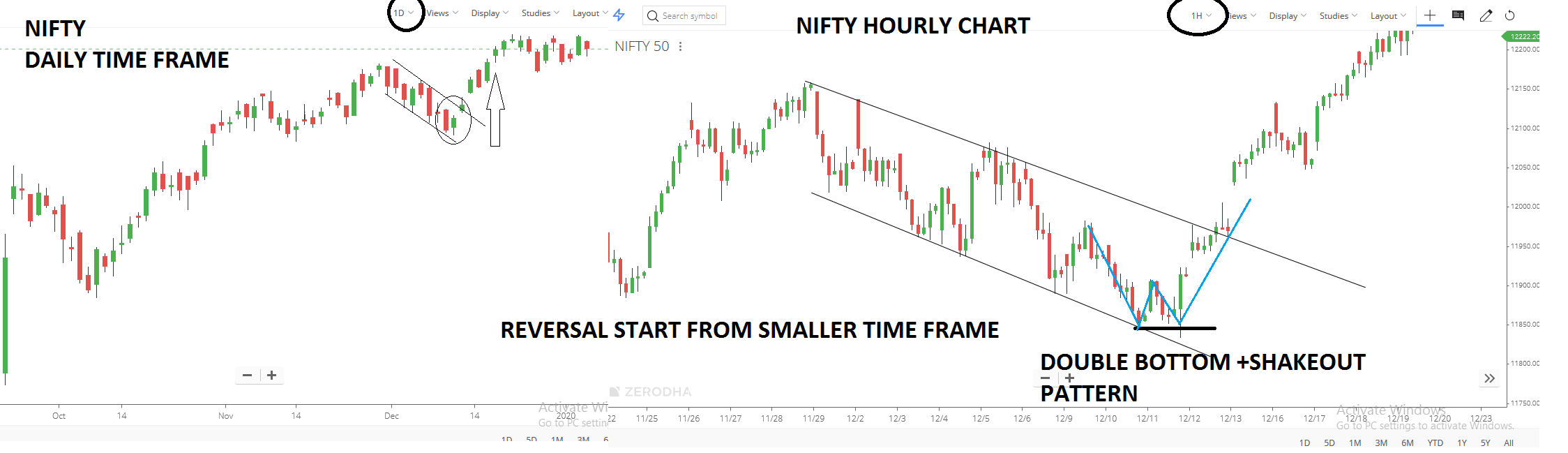

While the bigger frame, like daily, is trending and in impulse, you would have CYCLES of impulses and correction in the hourly frame. This is the most important phase. You have to find the conjunction when the hourly comes in the impulse.

Let’s take the day trading example

Daily time frame market overview (uptrend)

Hourly time frame strategy development (price reverse after a pullback )

5minute timeframe execution

Day Trade when the long-term structure, daily swing structure, and intraday structure are all synchronizing

TAX

Open the chart and start the top-down analysis, from a monthly chart to 15-minute chart.