What is an IPO?

Let me first give a brief about the IPO. It refers to the initial public offer made by any company. In simple terms, when a company raises money from the public for the first time, it is called an IPO. In India, there are mainly two stock exchanges: the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), where companies can list their shares and the general public, like us and the Institute, can purchase and trade shares of this company after listing.

The question is: how can we get some benefit from listing this company?

I am mainly writing this from the point of view of a small individual investor with small capital.

So there are several ways from which we can take advantage of the IPO. Before that, we have to understand the process of an IPO in brief( I used to see this while I was planning to invest in any IPO).

-

- Companies file their Red Herring prospectus on stock exchanges to raise money.

- Investors make an application on their Demate account to subscribe to the to the IPO.

- The company allots securities and then lists them on the stock exchange.

The first part comes into play in step 2, when investors make an application to a company to subscribe to their IPO. As an individual investor, we usually have approx. 3 working days to subscribe to an IPO. Before making an application, I used to check some factors before making an application, like

-

- What is the financials of the company?

- Does that company have any recognised brands?

- Who are the underwriters of IPOs?

- What is the total issue size, and how much of it is available for retail investors?

- What is the subscription rate at the end of the last day of application?

- Main Thing What is the Grey Market Premium (GMP) of a share before the application date and throughout the application date?

For decision-making, I mostly used to apply for an for an IPO on the last day of the application before closing the market around 2:00 PM to 3:00 PM.

The main reason is that I got reasonable confirmation on my side that the IPO is fully subscribed. b) QIB and HNI have subscribed enough; c) what is GMP on the last day of application?

Mostly, it worked for me that if I got an IPO allotment, there was less chance that the IPO would open negative. (Due to this, I didn’t make an application for PAYTM, even though GMP was positive.)

The first thing is here We can get the benefit of listing shares on the very first day and in the very short term (from making an application to listing shares on the stock exchange) if we get an allotment.

But as per my experience, there is a very low chance you got allotment of any IPO because mostly it is like a lottery, which means if IPO is oversubscribed by 20X, then your chance of getting allotment is 5% (1/20 * 100); if IPO is oversubscribed by 50X, then your chance of getting allotment is 2% (1/50 * 100). If you want to calculate the probability of getting an IPO allotment, you can simply divide it by the number of times the IPO gets oversubscribed.

So, I started to search for some behaviour post-IPO listing for different time horizons.

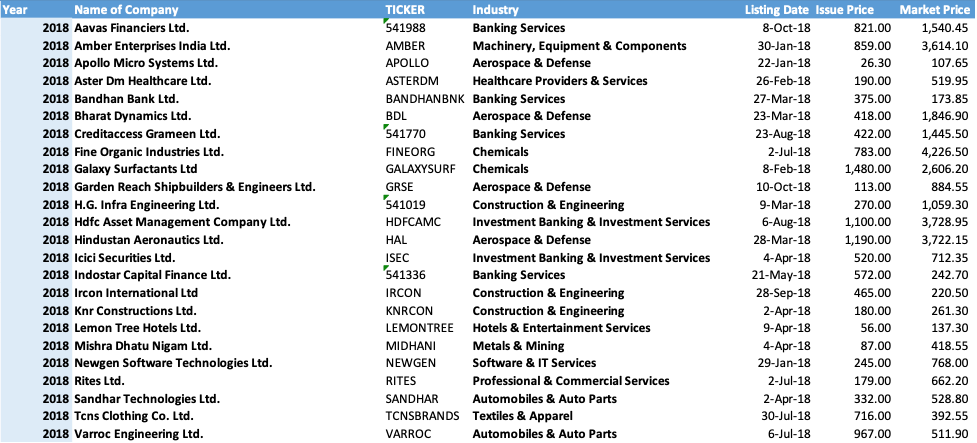

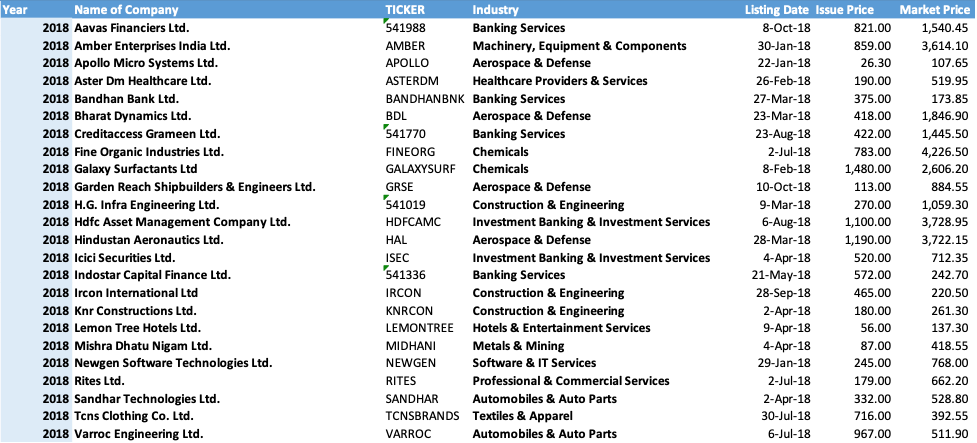

So for that, I took most of the sample of 180 Main Board IPOs listed on the NSE from 2018 to 2023 for study.

I am attaching a screenshot for your reference.

Check out the whole sheet : https://docs.google.com/spreadsheets/d/1DvDG2VdXMfOhd4QGUwztKFA6MZtDRz5OAuUENudBKhc/edit?usp=sharing

Following this, we went into some detail. Since the company is new on the stock exchange, its visibility is much higher in the listing month compared to other companies.

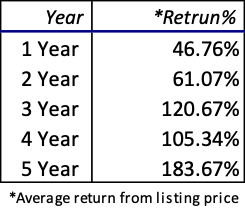

So for our study, we first did some calculations on the macro level, i.e., the yearly return. We took a 1–5-year return from the listing date. For Eg. So, for this study, if an IPO was listed in 2018, we used data from five years ago, if it was listed in 2019, we used data from four years ago, and so on.

And the result was stunning. We took the average return on stock from the listing date, and the result is below.

We can see that there was an average positive return of 46.76% in the very first year, even by buying one share of the IPO company on the day of listing. And for the third, we saw that the IPO got a double from their initial listing. We can interpret that, on a long-term basis, on average, we see a positive return even after investing after the listing of an IPO.

But this period might be long for someone. For that, we go to Level 1 in depth and collect data on the return of stock at the end of 1 month, 2 months, 3 months, and 6 months, and we see that the results are good. Below is the average return on stock for the horizon mentioned above.

Again, we saw a good trend that, in the very first month of the IPO, the average return of stock was around 19.55%, even after buying after the listing of the IPO.

This was a normal study; we can go into more depth, like what would be returned from day 1 to day 30. but for now, it is enough.

For clarification, we haven’t normalised any abnormal return or loss, and the data are historical. Do your own research before coming to any conclusions. We are attaching below a file of stocks listed from 2018 to 2023 for your reference. If you want to do your research, you can use this file.