In this blog, I will discuss Supply and Demand Zone Trading in detail. Please read our previous article discussing How to Trade with Smart Money. As part of this article, we are going to discuss the following pointers, which are related to Supply and Demand Zone Trading.

- Structure of the Market.

- What is the Supply-Demand Zone in Trading?

- How do you find a supply-demand zone in trading?

- Different types of zone

- How do we measure the strength of the zone?

- When did the supply and demand zone break?

- How do we trade with the supply and demand zone?

- Odd enhancer for trading with supply and demand zone

STRUCTURE OF MARKET

The price goes through the following phases

- ACCUMULATION

- REACCUMULATION

- UPTREND

- DISTRIBUTION

- REDISTRIBUTION

- DOWNTREND

ACCUMULATION Smart money removes the floating supply of stock by buying. This process is called accumulation.

TREND UP Smart money aggressively moves prices up

DISTRIBUTION SM will take advantage of the higher prices obtained in the rally to take profits by beginning to sell the stock back to the uninformed traders/investors

LAWS OF SUPPLY AND DEMAND Trading

All financial markets work on the universal law of Supply and Demand.

Law of Demand– The higher the price of an item, the less the demand (buyers don’t want to buy at a higher price), and the lower the price, the higher the demand (buyers want to buy at a low price)

The Law of Supply- The higher the price, the higher the supply (sellers want to sell at a higher price), and the lower the price, the lower the supply(sellers don’t want to supply at a lower price.

What are Supply and Demand Zones

Supply-demand is nothing but the border area of support or resistance

Let’s analyze NIFTY 50 STOCK

In the chart above, you can see a demand zone (broad support level) and a supply zone (broad area of resistance).

What we want to find at the price zones where supply overwhelms demand and supply overwhelms supply.

- The former is known as SUPPLY ZONES. When the market bumps into SUPPLY ZONES, the price will drop. Then, you can make money by shorting the market.

- The latter is the market DEMAND ZONE. With the support of demand, the price will rise. Then, you can profit in a long position.

- If the supply zone is broken, it becomes a demand zone. pullback test from the demand zone, you can go long.

How to Find Supply and Demand Zones in Trading

Two steps to identify the supply and demand zones.

- Look at the chart and try to spot large successive candles. It is important that the price moves a lot.

- Establish the base (usually sideways price action area) from which the price started the quick move.

Different Types of Supply and Demand Formations

There are different supply and demand zone patterns. Some of the more popular ones are shown below:

TREND CONTINUOUS BASE

- RALLY BASE RALLY(RBR)

- DOWN BASE DOWN (DBD)

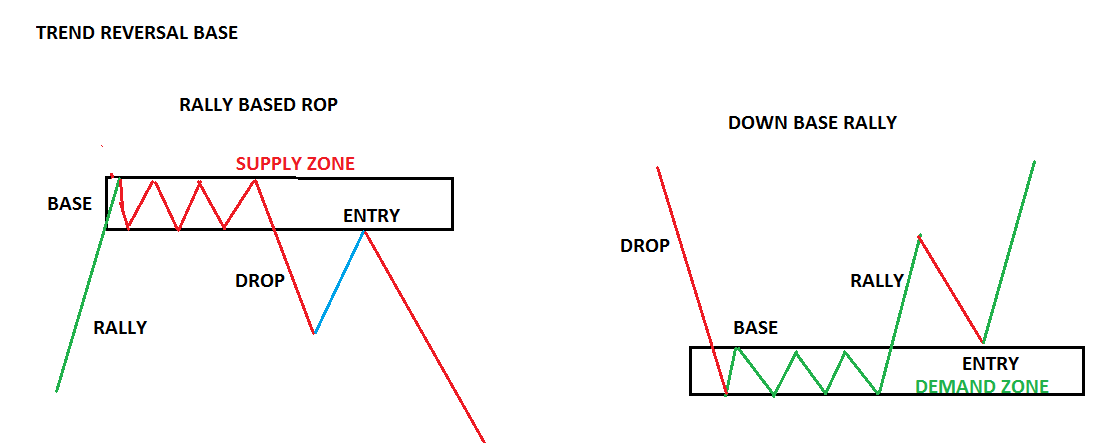

TREND REVERSAL BASE

- RALLY BASE DROP (RBD)

- DOWN BASE RALLY (DBR)

And

FLIP ZONE

NOW, PUTTING ALL THIS INTO A NIFTY 50CHART

STRENGTH OF SUPPLY AND DEMAND ZONE

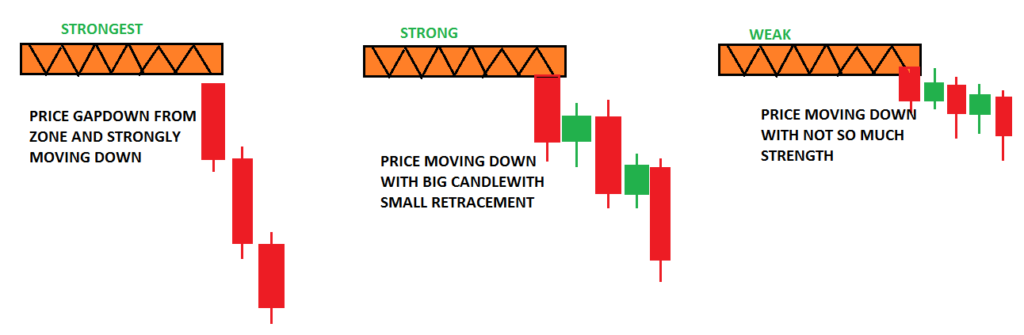

How did the price leave the level? STRENGTH OF THE MOVE

The Logic: The stronger the price moves away from a zone, the more out-of-balance supply and demand are at that zone. A heavy order is placed by smart money.

How much time did the price spend at the zone? TIME AT LEVEL

The Logic: The less time the price spends at a zone, the more out-of-balance supply and demand are at the price level. Smart money aggressively entering

At price levels with supply and demand zones more out of balance, the price will spend the least amount of time at the level

How far did the price move away from the zone before returning to the zone?

The Logic: The farther the price moves away from a zone before returning to that zone, the greater the reward to risk and probability.

When the price returns to that supply level for our short entry, we have a good idea of where the buyers are (the demand) and, just as importantly, where they are not.

How many times is the price approaching the zone? FRESHNESS OF BASE

First-time stock retrace to the base is the strongest to enter

When does Supply/Demand break?

Supply and Demand levels eventually break after a zone is tested many times or during a strong move. This is due to the remaining orders being triggered and gradually removed or an overwhelming number of orders in the opposite direction breaking the level.

Price action

- If the price stays near or at these zones & doesn’t fall much, then there is a high probability that they will break the zone

- A strong move to the zone may break the zone

- low volume test confirms the zone

HOW TO ENTER DEMAND AND SUPPLY USING PRICE ACTION?

- Find the SD zone on HTF(HIGHER TIME FRAME), then wait for the price to come to this level

- See any acceptance or rejection from this zone on trading time frame(TTF)

- Any reversal price action signal on TTF

- Entry in the direction of the dominant trend

- Suppose context downtrend, price rally to the supply zone on TTF, then any bearish reversal PA signal for an entry short

- Also, notice the volume on these reversals. A low-volume test is a good sign & they are highly probable trades.

TIPS for day trading: The supply and demand zones are high on the previous day and low on the previous day. Look for price action around there for acceptance or rejection of these zones.

Find the supply and demand zone in a higher time frame

In an hourly time frame, we find the zone

Big picture shows

1. whether the trend is up or down – determines which side we want to be on

2. Where are the big-picture support and demand levels?

We don’t want to be long below the supply zone

WHEN THE PRICE APPROACHES DEMAND ZONE

WE WANT TO SEE SIGN OF STRENGTH PRICE ACTION FOR CONFIRMATION OF THE ZONE

- MOMENTUM LOSS(DECREASING CANDLE RANGE AND BODY

- LOWER WICK

- MIX OF BOTH RED AND GREEN CANDLE

Entry on the trading time frame

ENTRY SIGNAL CANDLE

Candlesticks in Supply and Demand

- PIN BAR

- ENGULFING

- OUTSIDE CANDLE

Odds Enhancers example

- Trade with the trend

- If INDEX AND SECTOR SHOWS POSITIVE, THEN GO LONG FROM DEMAND ZONE

Supply and demand zone trading is just one of many strategies traders use, and, like any strategy, it is not foolproof. It requires a good understanding of market behavior, patience to wait for the right setups, and strict discipline to follow a pre-determined trading plan.