In this article, I will discuss Thrust Pullback and Measuring Move Analysis in detail. Please read our previous article, which discussed Advanced Price Action Analysis. As part of this article, I will discuss the following pointers in detail related to Thrust Pullback and Measuring Move Analysis.

- Thrust and Pullback Analysis

- Measuring Move

- Volume and Price Analysis

Thrust, Pullback, and Measuring Move Analysis

The strengthening or weakening of a trend may also be observed through the analysis of thrust and pullback and measured move.

THRUST Analysis

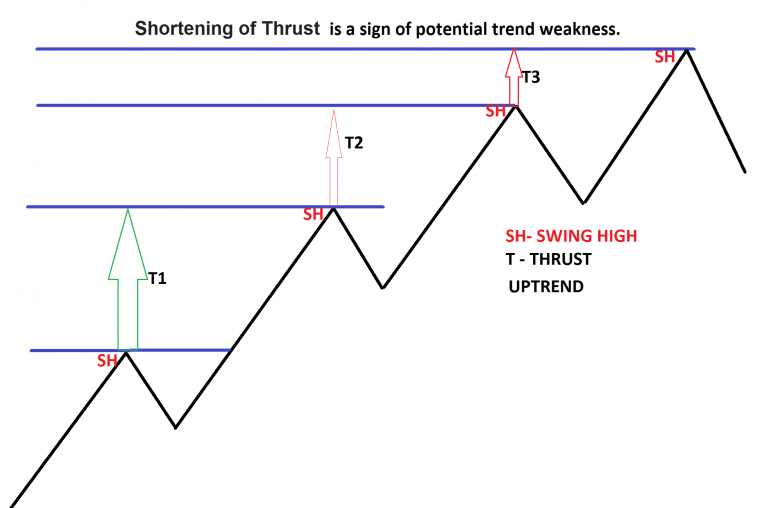

Thrust Refers to the distance between the current swing high and a previous swing high (in an uptrend) or swing low (in a downtrend). Increased thrust is a sign of potential trend strength. The shortening of Thrust is a sign of potential trend weakness.

The increased thrust of T2, when compared with T1, indicates greater strength within the trend. It also compares with T3 to T2, indicating strength on the upside.

Shortening of thrust, T2, when compared with T1, indicates weakness with the trend. T3 is then much shorter than T2, indicating weakness developing with the trend. T2 is unable to project to the same distance as T1 did. Something has shifted in the balance of supply and demand. The fact that the market could not do so indicates either a decrease in bullish pressure and/or an increase in bearish pressure.

The uptrend is showing signs of weakening

ALL REVERSE FOR DOWNTREND

DEPTH OF Pullback

DEPTH Pullback refers to the distance with which a price retraces the previous up move or impulse move

Increased depth is a sign of the potential weakness of a trend. Decreased depth is a sign of the potential strength of a trend.

PULLBACK DP1 is the distance with which the pullback retraces IMPULSEMOVE IM1. DP2 is the depth with which the pullback retraces IM2. And DP3 is the depth with which the pullback retraces IME3

Note that

DP2 has a much smaller percentage of its IMPULSE MOVE IM2 than DP1. D2 has a smaller depth than D1, indicating a potential weakening of the bears and, therefore, strength within the price trend.

DP4 is significantly larger than DP3, indicating potential strength within the bears and potential weakness within the price trend. The increased depth of pullback DP3 indicates increasing bearish pressure and a potential trend weakening.

The same concept applies to the downtrend.

ADVERTISEMENT

MEASURING MOVE (relative strength of move)

Comparing impulse swing with the previous impulse swing in the same direction to find whether strength is increasing or decreasing or equal

Volume and Price Analysis

Before going forward, we have to identify a few terms:

Swing: A high or low where the price changes direction.

Leg: The distance between two swings

General Rules for Interpreting Volume to determine the health of a trend

1.) If the PRICE rises and VOLUME rises, the market is STRONGLY BULLISH.

Volume helps us to determine the health of a trend. An uptrend is strong and healthy if volume increases as the price moves with the trend and decreases when the price goes counter-trend (correction periods or ‘pullbacks’).

2.) If the price rises but VOLUME falls, the market is WEAKLY BULLISH.

When prices rise, and volume decreases, it tells that a trend is unlikely to continue. Price may still attempt to rise at a lesser pace, and once sellers take control (which is usually signified by an increase in volume on a down bar or candle), prices will fall

3.) If the PRICE is falling, VOLUME is rising, and the market is STRONGLY BEARISH.

4.) If the PRICE and VOLUME are falling, the market is WEAKLY BEARISH.

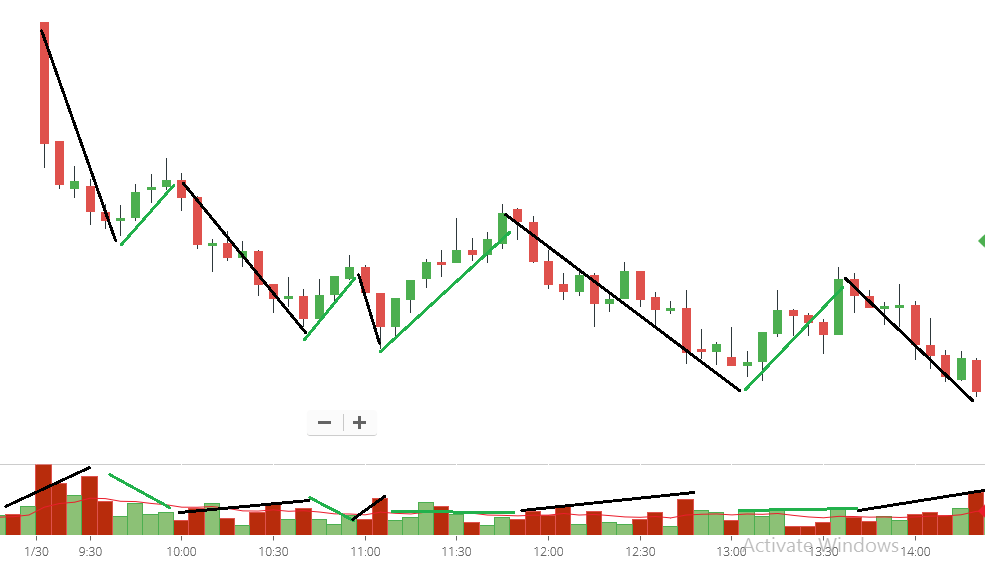

Volume strength and weakness analysis

Volume is always analyzed by comparing it to previous legs or swings. The reason for volume analysis is to look for increases or decreases compared to previous swings or legs to identify whether there is an increase or decrease in strength.

1) Compare the volume of the current price swing with the volume of the previous price swing in the same direction.

2) Compare the volume of the current price swing with the volume of the previous price swing in the opposite direction.

ADVERTISEMENT

Compare the volume of the current price swing with the volume of the previous price swing in the same direction.

This means comparing the current impulse swing vs the previous impulse swing. What is it telling? Volume increasing or decreasing or the same volume.

LEFT SIDE image 1

Compare the volume of UP-swings (A) and (B). Note the decreased VOLUME of the leg (B), indicating a reduction in bullish VOLUME. Weakness is appearing on the bullish side.

When comparing the current up-leg B volume with the previous up-leg A volume. It shows volume decreasing. When prices are rising and volume is decreasing, it tells that the trend is unlikely to continue. Price may still attempt to rise at a slower pace, and once sellers take control (which is usually signified by an increase in volume on a down bar or candle), prices will fall.

RIGHT SIDE IMAGE 2

When comparing the current up B leg volume with the previous up leg A volume. Note the increasing VOLUME on A legs, indicating an increase in BULLISH STRENGTH. BULLISH price swings are showing signs of strength

ALL CONCEPTS REVERSE FOR DOWNTREND

Compare the volume of the current price swing with the volume of the previous price swing in the opposite direction.

This means comparing impulse volume vs retrace volume. Generally, a healthy trend is increasing volume on impulse movement and decreasing retrace volume.

LEFT SIDE IMAGE 1

When comparing the current up-leg B volume with the previous up-leg A volume, the volume decreases. Strength is now clearly on the BEARISH side.

Price movement is expected in the direction of strength. When prices rise, and volume decreases, it tells traders that the trend is unlikely to continue. Price may still attempt to rise at a slower pace, and once sellers take control (which is usually signified by an increase in volume on a down bar or candle), prices will fall.

RIGHT SIDE IMAGE 2

When comparing the current up B leg volume with the previous up leg A volume, it shows that the price is rising and VOLUME is rising, which means BULLISH PRESSURE OVERCOME BEARISH PRESSURE. TREND CONTINUE IN UP DIRECTION