In this article, I will discuss VWAP Trading in detail. Please read our previous article discussing Multiple Time Frame Analysis for Intraday Trading. You will understand the following pointers in detail at the end of this article.

- What is VWAP Trading?

- A complete VWAP Trading system

- 2 VWAP Strategies

WHAT IS VWAP Trading?

Volume weighted average price (VWAP). These tools are used mostly by short-term traders and in algorithm-based trading programs. VWAP is often used to measure the trading performance of smart money. Professional traders who work for investment banks or hedge funds must trade large shares each day and cannot enter or exit the market by buying or selling a large position in stock during the day. Institutional traders compare their prices to VWAP values.

Two words are used here (PVWAP and VWAP)

PVWAP is the end of the VWAP value of the previous day. VWAP is a current-day VWAP. PVWAP can be obtained by plotting a straight horizontal line on the chart and looking at where it was plotted at 3:30 PM. VWAP is obviously current-day VWAP, which can be obtained by plotting the VWAP indicator.

VWAP day Trading system

Step1: location (refer to multiple time frame trading video)

- define a trading range(NEAREST SUPPLY AND DEMAND ZONE)

- where price open, where wants to go(with respect to nearest supply and demand zone)

Step2: relative strength and weakness compared to sector and index(refer to intraday trading course part 1)

If the respective sector is negative, choose a weak stock to sell. If the index (nifty) is negative, choose the weak sector.

Step3: MARK OPENING RANGE

Mark opening range (first high and low of the day)

Step4: condition and entry type

Rules for entry

- Do not play stock long that is below the VWAP

- Do not play stock short if above the VWAP

- If the price is above, both PVWAP AND VWAP look for long

- If the price is below both PVWAP AND VWAP, look for short

- A five-minute candle should not be closed below VWAP for a long entry. reverse for short entry(why that shows day going to be a range day)

- 1st candle of the day should be heavy volume. Why heavy volume on the first candle of the day? We are trying to identify the SM sentiment for the day. If SM wants to buy stock, we would see that on the open with heavy volume and a strong directional move. Stock may gap at the opening. This shows that the stock may trend up for the rest.

VWAP PULLBACK entry type

- VWAP PRICE CORRECTION

- VWAP TIME CORRECTION

Step5: Entry

If conditions are valid

Step6: Active trade management

Exit method

- Target exit

- Reversal development exit

WHAT IS VWAP PULLBACK STRATEGY

FIRST UNDERSTAND WHAT IS PULLBACK

A pullback is a price movement that moves in against the trend. It is a temporary price movement before it resumes back into the main market direction. Pullbacks are sometimes referred to as price Corrections or retracement.

VWAP PRICE PULLBACK ENTRY

CHARACTERISTICS of WEAK PULLBACK

- Correction(depth of pullback) must be small and without strong momentum candlestick.

- Volume decreases / low volume correction

- A great mix of red and green candles with a light volume

- Closes towards the middle with wicks

LOGIC OF VWAP PRICE PULLBACK ENTRY

If a stock moves strongly in the morning, supported by smart money, it respects VWAP. When a stock is traded above the VWAP, if VWAP is rising, then it shows buyers in control. When a stock is traded below the VWAP, if VWAP is falling, it shows sellers in control.

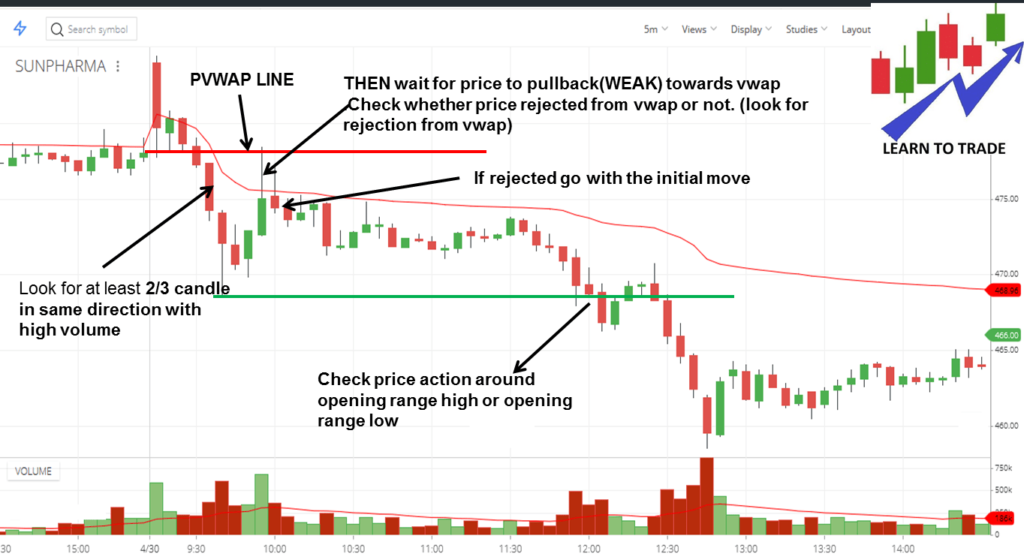

Step to follow

- Find the stock in a clear trend up (HH/HL) or trend down(LH/LL). Look for at least 2/3 candles in the same direction with a high volume.

- THEN wait for the price to pullback(WEAK) towards VWAP

- Check whether VWAP rejected the price or not. (look for rejection from VWAP)

- If rejected, go with the initial move

- Don’t buy aggressively until this stock heads in the initial direction.

- Check price action around opening range high or opening range low

- Those stocks that trade back above the opening range price are likely to go even higher. This is because of a new bull entry plus a short cover buy order, so after the reaction period, the market set the tone of the morning trend

TIME PULLBACK

TIME CORRECTION(Stock to digest the directional move is through a time correction. In a time correction, the stock moves horizontally, with volatility trendless. Generally, a strong trend has time correction. Because the pullback is shallow, it isn’t easy to time your entry on a pullback. Instead, you can look to trade the breakout.

What is happening here?

- The initial upward movement shows the direction of major interest. Then, a stock meets resistance and consolidates under this level. If the stock is strong enough to stay close to the resistance level without sharp retracement, it means that the path of least resistance is still upward and that the stock is likely to continue in the same direction as soon as it digests the distribution.

- Smart money slowly and discreetly accumulates its positions in sideways price action, where it can perfectly hide its activity. This is a place where big institutions are getting ready for action.

- Once bulls are confident that the bears will fail to reverse the trend, bulls buy again with a tighter stop loss.

- We prefer the range of the consolidation to be narrow

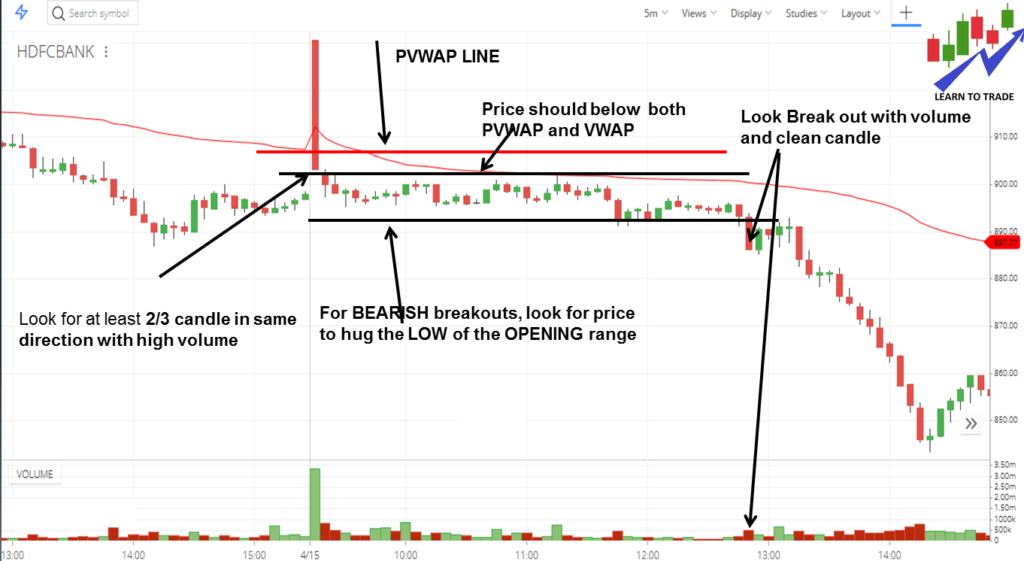

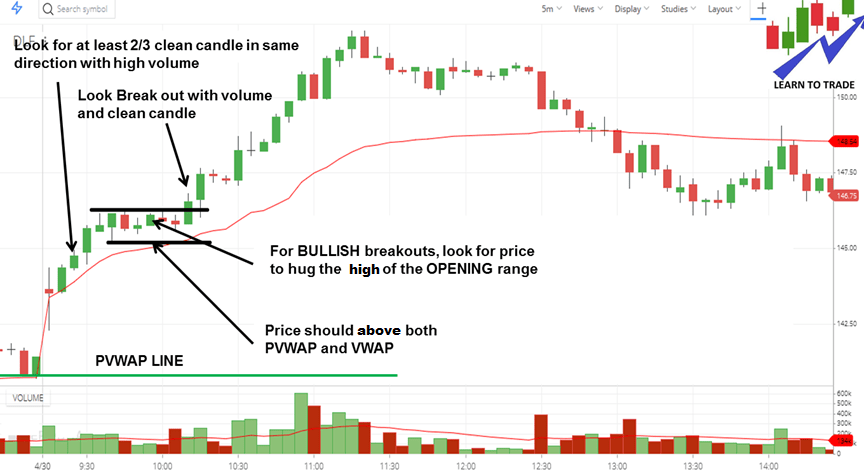

Step to follow

- Find the stock in a clear initial move with high volume.

- For bullish breakouts, look for a price to hug the top of the range. For upward breakouts, trade only those situations where the price most often closes above the middle of the opening range. Downward breakouts from the opening range do best when the price often resides below the range’s midpoint.

- The price should be above both PVWAP and VWAP.

- Trade with the trend. In a bear market, downward breakouts tend to make more money than upward breakouts in intraday trading. In bull markets, upward breakouts make more money.

- Look, Break out with volume, and clean the candle.

- After the breakout, the stock exhibited bullish price action. I mean, breakout should follow through.

What invalidates our setup?

- Price takes too much time during consolidation.

- Price should not break the initial move high(for long entry)during consolidation for an upside breakout.

- The first candle has both upper and lower long wick

VWAP can be valuable in the trader’s toolkit, particularly for short-term, intraday trades. It’s used not just as an indicator for trade entry and exit but also as a performance evaluation tool to understand how efficient a trader’s execution is relative to the market.