In this article, I will discuss the VWAP Trading Strategy in detail. Please read our previous article, in which we discussed the Breakout Trading Strategy. As part of this article, we will discuss the following VWAP Trading Strategy concepts in detail.

- What is the VWAP Trading Strategy?

- Uses of VWAP

- Limitation of VWAP

- VWAP Strategies

What is the VWAP Trading Strategy?

VWAP stands for Volume Weighted Average Price. These tools are used mostly by short-term traders and in algorithm-based trading programs.

VWAP is often used to measure the trading performance of smart money. Professional traders who work for investment banks or hedge funds need to trade large shares each day and cannot enter or exit the market by buying or selling a large position in stock during the day. Institutional traders compare their prices to VWAP values.

A buy order executed below the VWAP would be considered a good fill for them because the stock was bought at a below-average price (meaning that the trader has bought their large position at a relatively discounted price compared to the market). Opposite for sell

Therefore, VWAP is used by institutional traders to identify good entry and exit points. Conversely, when a professional trader has to get rid of a large position, they try to sell at the VWAP or higher. VWAP has the big advantages of the timeframe you chose, VWAP is the same.

Use of VWAP Trading Strategy

- VWAP shows who is in control

- VWAP can determine the market trend at the opening

- VWAP acts as support and resistance

VWAP shows who is in control

VWAP is an indicator that indicates who is in control of the price (the buyers or the sellers). When a stock is traded above the VWAP, the buyers control the price, and there is a buying demand. When a stock price breaks and closes below the VWAP, it is safe to assume that the sellers are gaining control over the price.

- If VWAP is rising, then it shows buyers in control

- If VWAP is falling, it shows sellers in control

- If VWAP is flat, it indicates no one controls the market and the price is in a trading range.

Used as Support and Resistance

Smart Money buys below VWAP and sells above it; if a large order comes to market, they buy from VWAP. When the price is unable to close below VWAP, gets rejected from VWAP, creates a shadow, or engulfs an outside bar, this confirms the support and resistance.

Price action and volume confirm the support and resistance

VWAP Trading Strategy USED TO DETERMINE THE MARKET TREND

Observations

- For bullish trend days, the market stays above the VWAP.

- For bearish trend days, the market stays below the VWAP.

- For ranging sessions, the market stays around the VWAP, which remains more or less flat.

These observations show that the VWAP has great potential for helping traders identify the market trend.

Note: To avoid trading at the opening of a trading session:

After the market opens, the price bars overlap with the VWAP. In the first five minutes, unknown heavy trading occurs between the overnight shareholders, new investors, and institutional traders. According to our method, you cannot judge the market bias until the market tries to move away from it.

After volatility decreases ten to fifteen minutes into the Open, the stock will move toward or away from the VWAP. This test is to see if a large investment bank is waiting to buy or sell. If a large institutional trader(smart money) aims to buy a significant position, the stock will pop over the VWAP and move even higher. This is a good opportunity for us to go long. Opposite for short selling. If there is no interest in the stock from market makers institutions or smart money, the price may trade sideways near VWAP. The best option would be to stay away from that stock.

Here, you’ll learn a price action method that you can immediately apply to your intraday trading to determine the market trend using VWAP.

TRENDING SESSION

Step1: Look for at least 2/3 candle in the same direction

Step2: When the first-time price approaches VWAP, Look for a push away from the VWAP(the price should not stall at VWAP)

Step3: Observe if that push enjoys follow-through or is rejected back to the VWAP level from the last swing high for an uptrend or last swing low for a downtrend

If they push away from the VWAP and have good follow-through, assume a trending session. You can then consider momentum trades in the direction of the trend. Assuming a sideways session if the market rejects the pushaway back to the VWAP. Consider taking mean-reversion trades in this case.

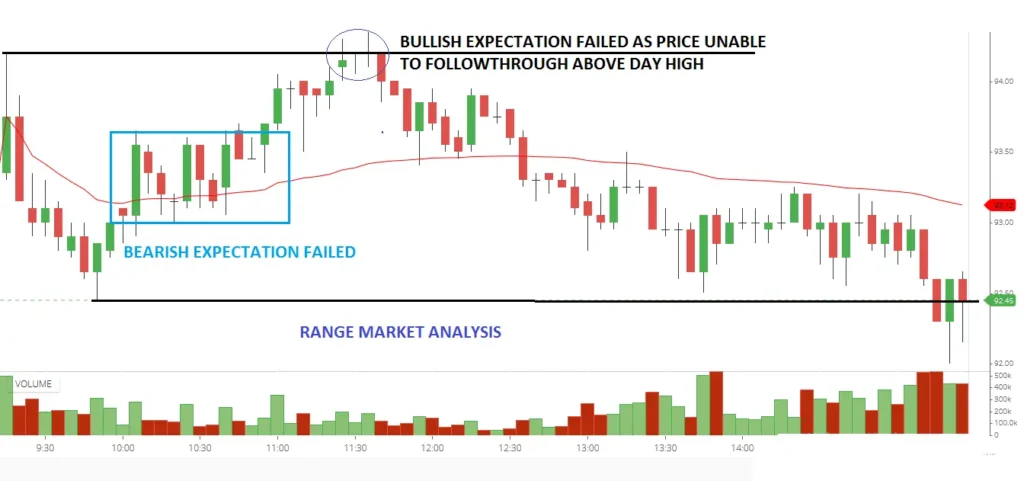

RANGING SESSION

A quote from James Dalton’s Mind over Markets: “Many knowledgeable professionals estimate that markets trend only 20 to 30 percent of the time. Failure to recognize this fact is one of the main reasons many traders don’t make money”. It is important not to trade if there is no trend or movement. Trading in a range only works if the range is large enough.

Smart money buys below VWAP and pushes above VWAP. When the price retraces to VWAP, see PA around VWAP for a continuous continuation of the existing trend or range market. If the market rejects the pushaway back to VWAP, assume a sideways session.

The characteristics of sideways markets are

- Price often near VWAP, Point of Control, or other equilibrium prices

- Price stays the whole day in the opening range (the span of the first hourly candle)

- Inside- and outside candles near each other

- Many crossings of VWAP

- High and low of the day hold throughout the day

LIMITATION OF VWAP Trading Strategy

- VWAP Trading Strategy Lags tend to increase as the day passes

- Cannot be used at the opening of the day

- Require supporting price action for entry

VWAP Trading Strategy PRINCIPLES

Two words are used here( PVWAP and VWAP). PVWAP is the end of the VWAP value of the previous day. VWAP is the current day VWAP. PVWAP can be obtained by plotting a straight horizontal line on the chart and looking at where it was plotted at 3:30 PM. VWAP is obviously current-day VWAP, which can be obtained by plotting the VWAP indicator.

CONDITION

- Do not play stock long that is below the VWAP

- Do not play stock short if above the VWAP

- If the way is extended from VWAP, then a play reversal is okay, but the target has to be the VWAP.

- If the price trades above PVWAP, it is bullish, and we look for a buy entry.

- If the price trades below PVWAP, it is bearish, and we look for a sell entry.

CONFLUENCE: USE VWAP indicator with price action and volume

ENTRY

- Buy Entry – For any 5-minute candle completely above both VWAP and PVWAP, the buy entry will be above the height of that candle.

- Sell Entry – For any 5-minute candle that is completely below both PVWAP and VWAP, the sell entry will be below the low of that candle.

NOTE:- Strategy doesn’t work on range-bound days

VWAP STRATEGY

VWAP REVERSAL ENTRY

VWAP REVERSAL FOR UPTREND

Rule

- The previous day should be a trend UP day

- Price should not close below the last swing low

- Price should close above the VWAP

- Look weakness for morning move into previous days VWAP (PVWAP) level

- Faster the better

- The volume is also important(prefer low volume move)

- Current day(ONE FIVE MINUTE) price should not close below the previous day VWAP(PVWAP)

- Take the trade only if I get a good entry and risk/reward ratio.

Reverse for downtrend

ENTRY PROCESS

Step1: find the stock in a clear trend up (HH/HL) or trend down(LH/LL)

Step2: Weak retracement move towards PVWAP

Step3: When the first time price approaches VWAP, Look for a push away from the PVWAP (the price should not stall at PVWAP)

Step4: Observe if that push enjoys follow-through or is rejected back to the VWAP level from the last swing high for an uptrend or last swing low for the downtrend

The price open and drive down with less volume shows signs of strength and stalls at P VWAP and cannot close below the PVWAP.

VWAP False Breakout (TRAP)

Strong Stock will stay and trade above VWAP if there is buying pressure from institutional traders. If a large investment bank is interested in taking the position, a stock will often stay above VWAP and keep moving above VWAP. However, if no large institutions are behind the stock, or if they fill all their orders, the stock will move back to VWAP and often “lose it,” meaning it will drop and trade below the VWAP. This is a sign that short sellers should start shorting it. On the other hand, when a stock below the VWAP bounces back and breaks out above the VWAP, it means the buyers are gaining control, and short-sellers desperately have to cover. Smart day traders chase the fleeing shorts by going long to ride the momentum and “squeeze the shorts.” Price action and volume play a major role.

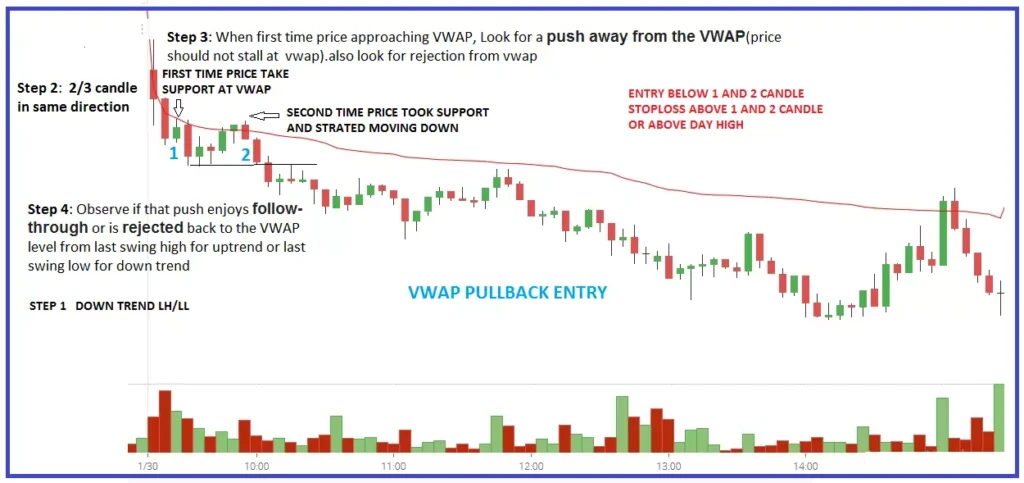

VWAP First Pullback

Step 1: find the stock in a clear trend up (HH/HL) or trend down(LH/LL)

Step 2: Look for at least 2/3 candle in the same direction

Step 3: When the first-time price approaches VWAP, Look for a push away from the VWAP (the price should not stall at VWAP). Also, look for rejection from the VWAP.

Step 4: Observe if that push enjoys follow-through or is rejected back to the VWAP level from the last swing high for an uptrend or last swing low for the downtrend

This is not a holy grail strategy. No strategy will give you a 100% win rate. This strategy works 60-80% for me. So, open the chart and practice before entering the live market. I would suggest going through the below link for more clarification on